“BBB”: BUILDING THE ROAD TO PERDITION

by Tagumpay Felipe

The Duterte regime’s much-touted “Build, Build, Build” (BBB) program is purported to be a “game changer” for the Philippines: they said it would accelerate growth towards a modern, industrialized economy. The program comes with a whopping price tag of Php 1.5 trillion, to be funded largely with foreign and local borrowing and increased taxation – both burdens ultimately to be borne by the masses.

Boldly, the regime claims that the BBB will lift 1.5 million Filipinos from poverty every year and reduce poverty incidence from today’s 22% to only 14% by the end of Duterte’s term in 2022.

It aims to achieve that by building as many as 75 infrastructure projects in various parts of the country. It avers that it will serve as the “solid backbone for growth.” Per June 13 reports, the implementation of 30 of the 75 projects are targeted to begin this year.

It is the BBB the Duterte regime invokes as rationale for the new taxes it has imposed this year on goods and services under the Tax Reforms for Acceleration and Inclusion (TRAIN) law.

But there’s a caveat to pursuing such an ambitious program.

Without addressing the country’s fundamental social and economic problems—such as landlessness, social and economic inequity, and multi-dimensional (economic, social, cultural, institutional) injustices—any economic program driven by massive infrastructure-building will primarily serve the interests of big business and the ruling elite, with little, if any, deepgoing improvement in the life of the poor majority.

The BBB’s monstrous tax-and-debt-driven budget easily conjures the image of hapless Filipino masses being crushed by the weight of trillions of pesos worth of concrete and steel.

Worse, instead of promoting self-reliant national development, the BBB program will lead the country on a disastrous road of indebtedness to and dependence on a fast-emerging foreign power: China.

Government tries to placate public unrest stirred by the TRAIN law. It saysthat up to 70% of revenues to be collected will be spent on the BBB. This is on top of other fund sources such as the floating of Php 12 billion in government bonds and a projected $167-billion loan package from China.

Already, the new taxes which took effect this year are being blamed for the highest inflation rates—3.8% in the first quarter of 2018, with a new high of 6.4% in August.

DEBT AND NATIONAL SOVEREIGNTY

But the loudest alarms are being raised about the serious repercussions on national sovereignty of getting heavily indebted to China.

Last March Zhuang Guotu, a Chinese academic from Xiamen University, said in an interview with the Global Times that “Chinese loans are usually accompanied by repayment agreements, which use certain natural resources as collateral.”

Duterte’s spokesperson refused to elaborate on that statement, dismissing it as “gossip.” China’s foreign ministry was likewise quick to shoot down Zhuang’s statement as his personal opinion and not reflective of the Chinese government’s policy or practice. But take note that Global Times is published by the People’s Daily, the mouthpiece of China’s revisionist ruling party.

China’s denial flies more in the face of what has befallen Sri Lanka. Last year Sri Lanka was forced to practically cede its strategic port of Hambantota to China, through a 99-year lease due to its inability to pay off more than $8 billion in debts to Chinese state firms.

Causing further suspicion is the thick veil of secrecy over the Duterte regime’s loan negotiations with China. To date, Duterte’s economic managers have not been transparent on what the actual interest rates, the conditions and repayment terms are of these Chinese loans.

Perhaps part of the reason lies in the fact that the terms are downright indefensible. Only last February, NEDA director general Ernesto Pernia caused an uproar when he admitted that the Duterte government has chosen to secure loans from China despite the far lower interest rates of 0.25% to 0.75% by other lender countries like Japan, as opposed to China’s 2-3%. This means it is 3,000% more costly to borrow from China.

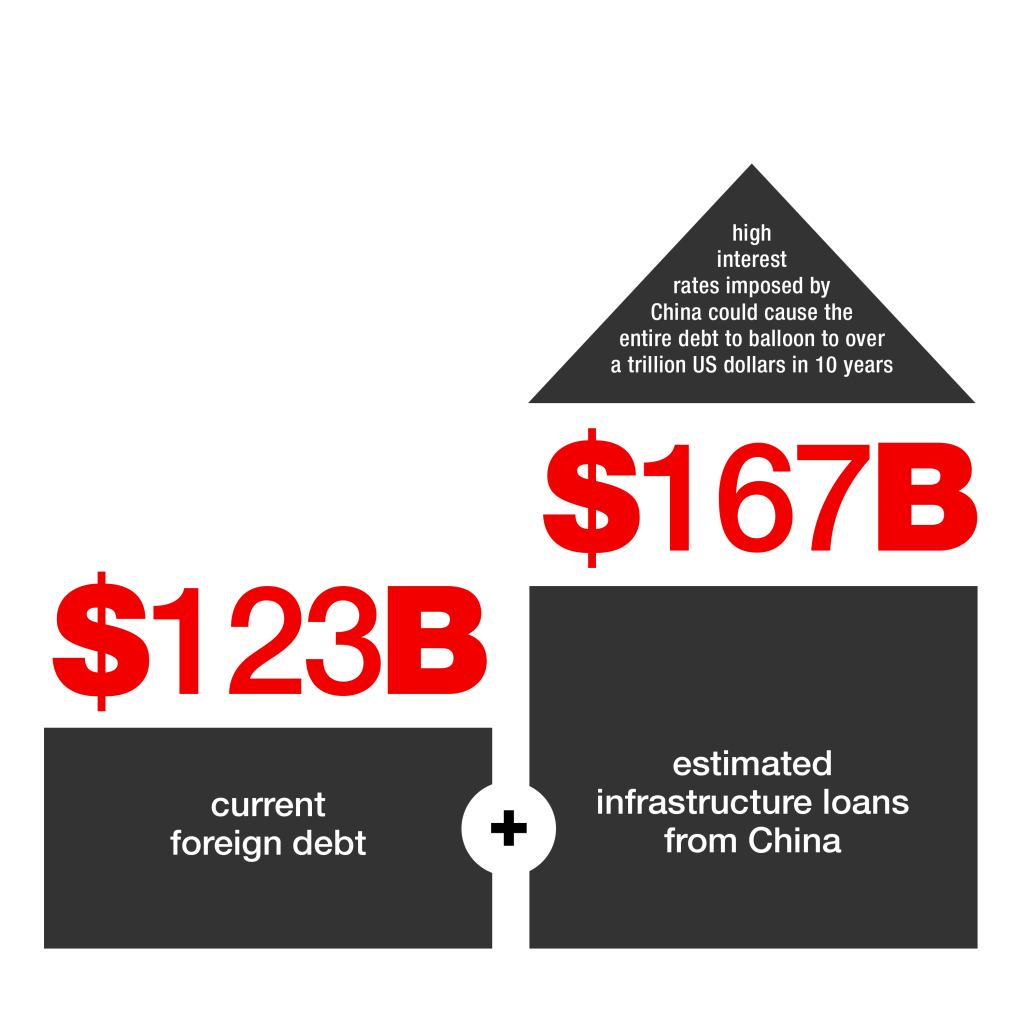

In May last year, an article published by the influential business magazine Forbes warned that “Dutertenomics, fueled by expensive loans from China, will put the Philippines into virtual debt bondage.” It predicted that with the estimated $167-billion infrastructure loans from China added to the Philippines’ current foreign debt of $123 billion, the high interest rates imposed by China could cause the entire debt to balloon to over a trillion US dollars in ten years.

“Once the country has trouble repaying $167 billion in debt, plus interest, to China,” wrote Forbes contributor Anders Corr, “the Philippines will have to give political and economic concessions to China in order to repay annual interest, or renegotiate such a large quantity of debt.”

Corr added that this could include political concessions, such as giving up territory or oil rights in the South China Sea or Benham Rise. Or it could include economic concessions, for example, selling China its national companies, or agreeing to below-market rates on exports to China.

National Democratic Front of the Philippines (NDFP) chief political consultant Jose Ma. Sison has followed up Corrs’ article by lambasting the Duterte regime for accepting not just loans at high commercial rates but also defective and overpriced supplies and services from China.

Upon loan default, Sison pointed out, the Chinese corporations would convert the loans to equity, giving the Chinese further control over Philippine natural resources (including the Exclusive Economic Zone and the Extended Continental Shelf in the West Philippine Sea), the entire Philippine economy and government policies through puppets and dummies.

LINING THE POCKETS

Duterte’s tack, Sison added, is a foolish repeat of the Arroyo regime’s preference for overpriced projects and high-interest loan agreements (such as the anomalous NBN-ZTE deal) that benefited most big compradors and corrupt bureaucrats in both China and the Philippines, including the Arroyo couple.

In a similar vein, Corr pointed out the possibility of Duterte and his influential friends and business associates benefiting from hundreds of millions of dollars in finders’ fees for facilitating the debt deals with China. What Corr has posited could well be the answer to the riddle of why the Duterte government has persistently been going for the Chinese loans even under terms patently detrimental to the national interest.

DRAFT CASER PROVISIONS ON INFRA DEVELOPMENT AND TAXATION

From the NDFP perspective, infrastructure-building should be part of a purposive, strategic economic plan for national development whose implementation shall be democratically decided, publicly transparent, and socially accountable.

In stark contrast to the BBB, this is the spirit of a people-centered economic development path under the NDFP’s draft Comprehensive Agreement on Social and Economic Reforms (CASER).

As the Duterte regime has abandoned the GRP-NDFP peace talks, it also scrapped any opportunity to forge the CASER—a would-be historic agreement which aims to “solve the fundamental problems of exploitation, underdevelopment and poverty in order to establish the basis for a just and lasting peace.”

The Duterte government has shown that it is no different from past reactionary regimes that erroneously believed change could be effected merely through infrastructure building, without touching in any way the underdeveloped, agrarian and semi-feudal economic landscape through national industrialization and genuine land reform. Without these necessary changes, any new infrastructure will end up facilitating and reinforcing the classic exchange of Philippine raw materials, semi-manufactured goods and cheap labor for finished products from overseas that has characterized neo-colonial trade and perpetuated the country’s economic backwardness.

In the NDFP’s draft CASER, several provisions call for massive state spending on infrastructure in the push to attain rural development and national industrialization. But it stipulates the creation of mechanisms to ensure the role of people’s organizations in the planning and implementation of infrastructure projects, in both cities and countryside.

The CASER upholds both the necessity of responsible state intervention and making the welfare of the people the center of economic policies.

Taxation is one of several sources mentioned in the CASER for financing the national industrialization drive, including the needed infrastructure support. But it clearly puts in place a progressive tax system that charges lower income taxes on the masses and small firms, and higher income taxes on the wealthy and large corporations.

The CASER provides for the abolition of the value-added tax (VAT) and excise taxes on basic goods and services consumed by the working people. Taxes on luxury goods and services, however, shall be increased, as will consumption taxes on alcoholic drinks, tobacco products, gambling and other socially or economically undesirable items.

The CASER also calls for regulations on public and private foreign borrowing to ensure that foreign loans support national development, and save domestic monetary and exchange rate, financial, and fiscal policy from being hostage to foreign interests due to debt bondage.

And while the CASER calls for breaking the country’s economic dependence on the US and Japan, it warns about developing new dependencies on other foreign powers.

Because Duterte’s ruinous road-building program is heading towards a debt-ridden future, it deserves to be rejected by the Filipino people.