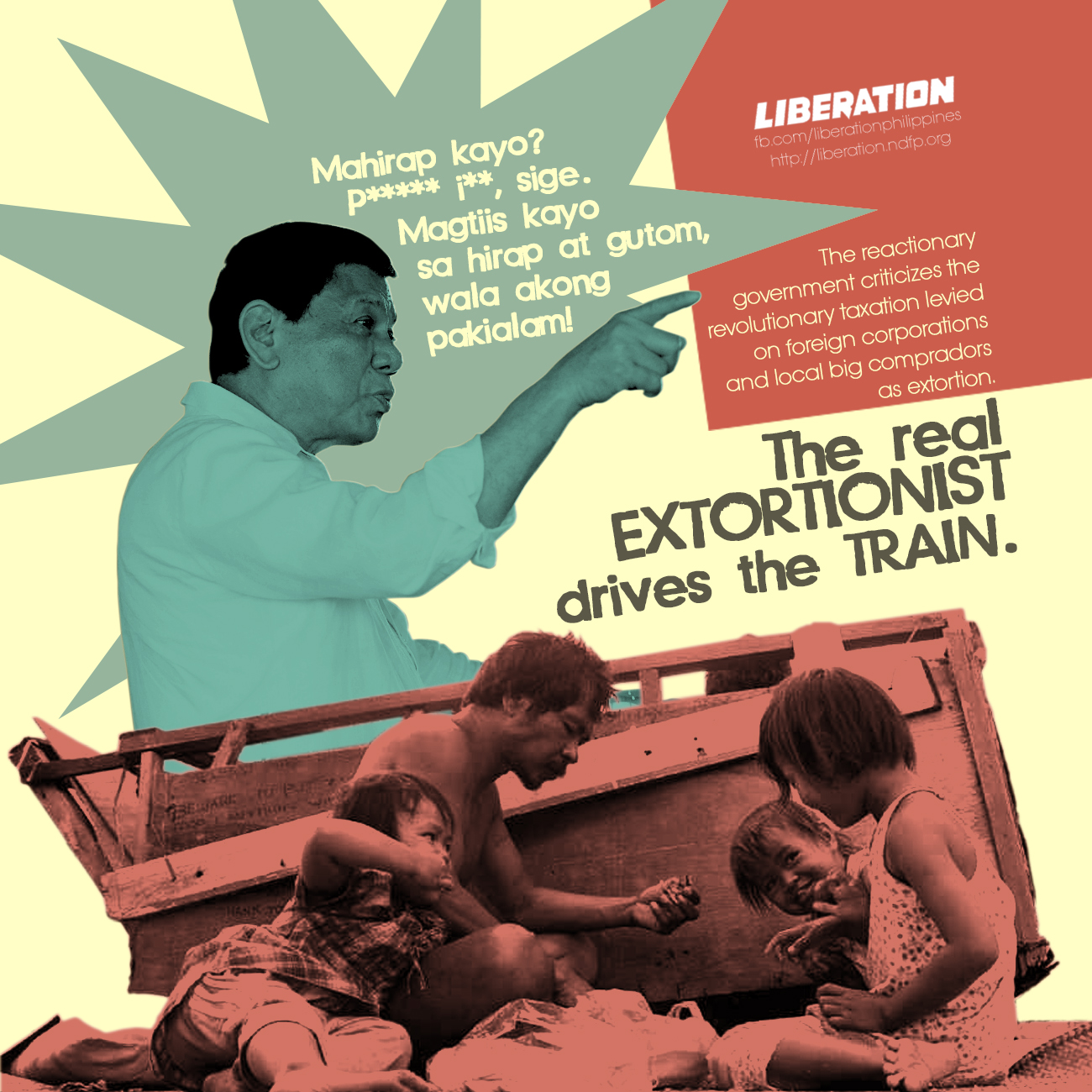

The real extortionist drives the TRAIN

by Liberation Staff

The reactionary government criticizes the revolutionary taxation levied on foreign corporations and local big compradors as extortion. But these taxes are for the use of the land and natural resources in the guerrilla fronts which truly belong to the people and should primarily benefit them. Unlike the bureaucrat capitalists in government, who extort and pocket people’s taxes for their personal aggrandizement, revolutionary taxes serve the masses and sustain the democratic revolution that will liberate them from the yoke of ruling class exploitation.

The Duterte government’s new tax reform package is one big extortion activity against the poor. Like a campaign promise aimed to lure and deceive, what the law offers in one hand it takes away by the other as expeditiously and as brashly. The Tax Reform Acceleration and Inclusion (TRAIN) Law, R.A. 10963, promised to benefit more workers as tax exemption is expanded to cover not only the minimum wage earners but also those in the middle income group receiving P250,000 per year. But, the adjustment in excise taxes of petroleum products such as diesel and LPG, coal and sugar-sweetened beverages and expansion of the tax base by removing Value Added Tax (VAT) exemptions have adverse repercussion especially on the poor. Increase in petroleum products adversely affects the price of electricity since bunker oil is used to fuel power generation, just as coal does. Price increases of diesel and gas, which are used to transport people and deliver goods, increase consumption spending.

Contrary to the Department of Finance (DOF) claims, majority of Filipinos, about 15.2 million families, will not benefit from personal income tax exemptions (PIT). They are either minimum wage earners who are already tax exempt or informal sector with irregular income who do not pay income tax. However, they will surely bear the brunt of the domino-effect price increases in hosts of goods, utilities and services.

The DOF continues to justify the TRAIN with its convoluted reasoning supported by an overdose of statistics. On the other hand, the mitigation measures offered by the government to cushion the TRAIN impact on consumer prices is an admission of the scourge faced by the poor from it. The measures include a 10% discount on NFA rice up to 20 kilos a month, tax reform cash transfer of P200 per month for the poorest 50% households starting in 2018, free skills training under TESDA-certainly a pittance mooched off “government magnanimity”.

Yet, what can be expected of a reactionary State ruled by majority of landlords and big compradors but legislations for their self-serving interests. The Build-Build-Build program obsession of the Duterte government for infrastructures, where most of the increase in taxes are supposedly trained at, serve the development and investments for foreign investors, local big compradors and landlords. Likewise, the increase in salaries of State armed forces is to oil their killing machine and perpetuate their fascist rule.

In contrast, the revolutionary taxes build schools to train not only the youth but also adults on crafts to increase income, as well as on numeracy and literacy; the peasants to improve their agricultural productivity and insure food sustainability. Through these, the masses in the far-flung areas long neglected by the imperial government can avail of health and medical services. The training of paramedics is an important aspect of these services. Cooperatives are put up to jump start their collective endeavour for improving their livelihood. All efforts help boost the communities’ self-reliance. While complying with the NDFP policy on environmental protection and ecological conservation, relief and rehabilitation program is likewise instituted to cope with calamities, including man-made disasters from destructive mining and logging of foreign and local corporations.

The national democratic revolution advances through the strength and determination of the revolutionary forces and the myriad support of the masses under the leadership of the Communists Party of the Philippines (CPP), the New People’s Army (NPA) and the National Democratic Front of the Philippines (NDFP). Revenues from revolutionary taxation, including voluntary financial contributions from nationalist businesses and enlightened gentry, who believe in the justness and necessity of the revolution, help in the advance the democratic struggle. These also provide for the needs of the NPA as they immerse, organize and serve the masses.

Hence, no matter how much the reactionary government vilified the revolutionary movement and its taxation activity, it has failed desperately. In the same breath, the reactionary government will fail, desperately, to check the advance of the people’s democratic revolution. ###